[ad_1]

The 2024 holidays delivered on, and actually surpassed, record-breaking projections for ecommerce. U.S. shoppers spent $241.4 billion on-line between November 1 and December 31 of this, up 8.7% from 2023, in keeping with Adobe Analytics.

Forward of the vacations, Adobe had projected $240.8 billion in ecommerce gross sales, up 8.4% year-over-year.

Dig deeper: 2024 vacation gross sales reside as much as record-breaking projections

Inflation. The record-setting holidays have been a results of robust client spending, not larger costs. Adobe’s Digital Worth Index confirmed client costs have fallen for 27 consecutive months and have been down in November 2.6% from the earlier yr. Attire was down almost 8% YoY in November 2024, in keeping with the Index.

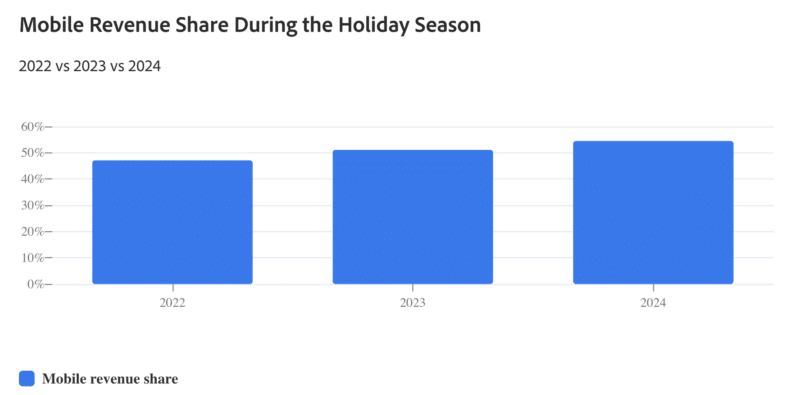

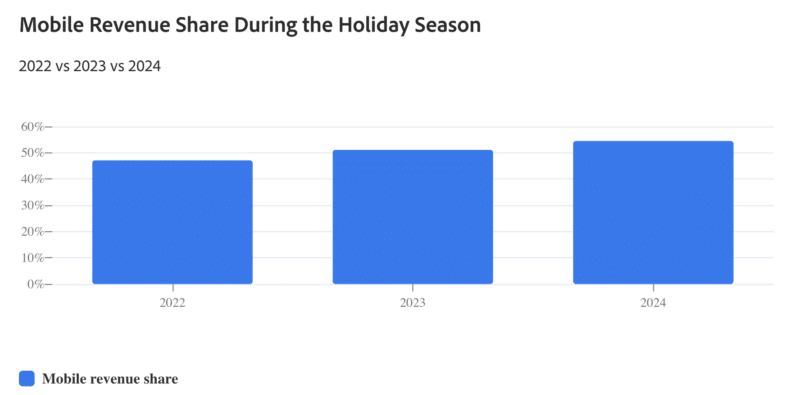

Cellular transactions. The 2024 holidays have been probably the most cell ever, in keeping with Adobe. Smartphones drove 54.5% of on-line purchases.

Moreover, 79.1% of Purchase Now, Pay Later (BNPL) orders have been made on a smartphone.

AI brokers. Site visitors to retail websites pushed by genAI-powered chatbots elevated 1,300% YoY, in keeping with Adobe.

An Adobe survey of 5,000 shoppers discovered seven in 10 respondents who used genAI-powered assistants discovered them useful.

Dig deeper: Will AI brokers conduct the martech orchestra in 2025?

High classes. Three classes accounted for over half (54%) of all ecommerce:

- Electronics: $55.3 billion, up 8.8% YoY.

- Attire: $45.6 billion, up 9.9% YoY.

- Furnishings/house items: $29.2 billion, up 6.8% YoY.

The best-growing class for ecommerce was grocery, up 12.9% YoY and accounting for $21.5 billion in gross sales. Second was cosmetics, up 12.2%, with $7.7 billion in gross sales.

Why we care. The gross sales information confirmed reductions contributed to robust vacation efficiency. As an example, the highest-selling class, electronics, benefited from the best peak reductions — 30.1% off the listed worth.

The broader story past the vacations is how shoppers are benefiting from reductions and cell buying experiences to buy product classes not related to gift-giving — groceries and furnishings. Vacation customers aren’t simply buying with the vacations in thoughts, so these tendencies apply year-round.

Extra Adobe Analytics information from the vacations will be discovered right here.

[ad_2]

Source_link